First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

#Ca tax brackets income for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For more form details and access to a tax calculator, head to the FTB website.The Forbes Advisor editorial team is independent and objective. Some taxpayers may need to file additional forms or schedules required depending on individual circumstances, such as if you have certain deductions or credits. You will need to file this form if you need to make changes or corrections to your previously filed Form 540 or 540NR. You will need to file this form if you are a nonresident who earned income in California or a part-year resident who earned income both in and out of California.įorm 540X: This is the Amended Individual Income Tax Return and is used to correct errors or make changes to a previously filed tax return. You will need to file this form if you are a California resident or part-year resident who earned income in California.įorm 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return and is used by nonresidents and part-year residents who earned income in California. There are several forms that may be required for California income tax returns, but the three main forms are:įorm 540: This is the California Resident Income Tax Return and is used by residents to report their income, deductions, and credits.

The which form(s) you need to file will depend on the amount of your taxable income, filing status, and residency status. Other forms of taxation in California include a 8.84 percent corporate income tax rate, 7.25 percent state sales tax rate, a max local sales tax rate of 2.50 percent, and an average combined state and local sales tax rate of 8.82 percent. Taxpayer are able to claim various deductions and credits to reduce their state tax liability, such as the standard deduction, itemized deductions, and various credits for things like child care expenses and renewable energy investments. California residents must file a state tax return if their gross income exceeds certain thresholds, even if they do not owe any taxes.

The Tax Foundation’s 2023 State Business Tax Climate Index, designed to show how well states structure their tax systems, ranks the California tax system 48th overall.ĬA income tax rates are based on a taxpayer’s taxable income and filing status.

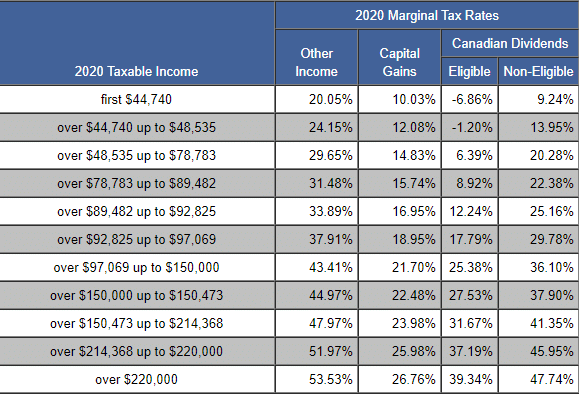

There are currently nine CA income tax brackets ranging from 1.00% to 12.30%. The more the taxable income, the more the income tax owed. The higher the earner, the higher tax rate. Though you won’t pay federal income taxes, you may still be required to file a California state tax return if you meet the state’s filing requirements.ĬA tax brackets are based on a progressive income tax system. Let’s say you’re not required to file a federal tax return.

#Ca tax brackets income professional#

It is important to seek advice from a tax professional or the California FTB if you may have California taxable income. So, if you have the slightest bit of curiosity as to if you have taxable income in the state of California, it is recommended to consult with a tax professional or the California Franchise Tax Board (FTB) for more specific guidance on non-resident tax obligations in California.Ĭalifornia has its own tax rules and regulations, which may differ from federal tax laws. Part-year residents who move in or out of California during the year and earn income from California sources while they are residentsĮven gambling winnings from California sources are subject to California state taxation. Non-residents who earn income in California, such as wages, salaries, commissions, bonuses, rental income, etc. Residents of California, regardless of their taxable income Are you subject to paying California state tax? As one would assume, California residents are required to file a California state tax return however, residents are not the only ones who may owe California income taxes.Īll who earn income from California sources or conduct business in California are subject to California taxes, regardless of their residency status.

0 kommentar(er)

0 kommentar(er)